Important: This feature is currently only available for our accountant and bookkeeper plans.

What is a PIER Report?

PIER is an acronym used by CRA that stands for Pensionable Insurable Earnings Review. Every year, when CRA receives your T4 employee slips, they run a PIER calculation to ensure employees and employers have contributed correctly to CPP and EI. The report in your PAYEVO account will recalculate CPP, EI, QPP and QPIP to see if there are any deficiencies that could have been caused by;

Incorrect Date of Birth that has been changed

Incorrect exempt settings that have been changed

Running too many regular pay runs

Manual modifications within a pay run

*All calculations are based on CRA and Revenue Quebec guidelines and formulas, but cannot account for some user errors that fall outside of these prescribed guidelines.

When to run a PIER Report

You should run a PIER Report before you run a final payroll, before terminating an employee, or before your last pay of the calendar year. This will allow you to make corrections in the final pay.

How to run a PIER Report

To start, you will need to know the number of pay periods worked by each employee. To get this, run a General PAY EXPLORER (DYNAMIC) Report for the entire year and export it to XLS. Review From/TO dates to look for duplicates. If there are multiple pay runs for the same work dates they are duplicates and will count as 1 period worked. Add up the number of periods worked after accounting for the duplicates.

To access the new PIER Report

A. Navigate to any report, and click the report dropdown menu.

B. Click PIER Report

Your real-time results will display onscreen based on the information in the system

For CPP/QPP you must update the Periods Worked (if different than how many pay runs were performed or date of birth was changed) and use the tab key/click elsewhere on the page to recalculate

Periods Worked are the number of Pay Periods the employee worked, regardless of the number of pay runs performed for that period. Example, you ran a regular, a special and a manual pay run all for the same work dates. This would count as 1 period worked because the work dates are all the same.

When you update the periods worked, click the Tab key on your keyboard, or click elsewhere on the screen with your mouse, to have it recalculate

If your employee turned 73 anytime this year, they should not be paying QPP, and the number of pay periods should be 0.

Each section has a PDF/XLS option to download the report and save it for your records. This report will regenerate each time you open it so we recommend saving each section

Understanding your Report

Only employees with a difference will show in your report

All sections have the following fields and their purpose is noted here

Employee name

Employee #

EI/CPP/QPP/QPIP Employee Calculated- This is the amount from the employee YTD

EI/CPP/QPP/QPIP Employee Recalculated- This is the amount it should be after performing the CRA PIER calculation method

EI/CPP/QPP/QPIP Employee Owing/Refund- this is the difference between the calculated and recalculated amounts and will be the field you will need to make adjustments

EI/CPP/QPP/QPIP Employer Calculated- This is the amount based on the employee YTD

EI/CPP/QPP/QPIP Employer Recalculated- This is the amount it should be after performing the CRA PIER calculation method

EI/CPP/QPP/QPIP Owing/Refund- This is the total from the Employer and Employee Owing/Refund section

CPP/QPP fields

CPP and QPP also include the Date of Hire, Date of Birth (DOB) and Periods Worked, as explained above.

- If there is a negative amount on CPP/EI Owing/Refund the employee/company have overpaid CPP/EI. If there is positive amount on CPP/EI Owing/Refund the employee/company have underpaid CPP/EI. Your total owing/refund shows at the bottom. All employee underpayments or overpayments will need to be handled manually and will not be processed in this reconciliation.

What to do if you show an Owing/Refund amount

Notice

*If the amounts are +/- $1.00 this could be a result of rounding individual pay runs. Typically these are ignored by CRA/MRQ

If you have an amount owing/refund in the Employee Owing/Refund Column you can make adjustments in the employee’s next pay.

If you plan on making changes in a pay run please download EACH section of this report where there is a balance for your records

On the employee’s next pay when you get to the review step of the pay run click on the employees name and ADD/SUBTRACT the owing/refund from their relevant tax box

Click save

Making this adjustment will update the employer portions as well

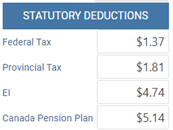

Example- employee 1 has overpaid CPP by $7.08

In the next pay run on the review step click on the employee’s name and reduce the CPP on screen by $7.08 and click save

Re-run the PIER Report to confirm and the employee should no longer show in the list

Remit to CRA as normal (via ePay with remittances or based on your reports)

If the employee no longer works for your company and there was an underpayment you can manually update the Employee YTD and save it. You are unlikely to receive a PIER from CRA or an assessment from MRQ, but you MUST

Pay any amounts owing directly to CRA/MRQ before your final remittance due date for the calendar year

Collect funds back from the employee directly

*See CRA/MRQ guidelines for what to do if you are unable to get funds back from an employee

If there was an overpayment and the employee no longer works for you DO NOT modify the employee YTD. The employee can claim overpayments back on their personal income tax returns. For company portions you will need to work with CRA/MRQ and your accountant directly to attempt to recover these funds.