Manual Pay Run for Reversals

Notice

Updated: Sep 1, 2021

The manual adjustment process detailed in this article has been deprecated as of Sep 1, 2021.

To correct a pay run, please use the new correction tool from within your account. For details see Undo A Finalized Run

Please note that this feature is available as an option to accounts with our accountant / bookkeeper partners

This feature DOES NOT create a negative bank file. If your clients are using ePay please contact us at support@paymentevolution.com to ask to stop the payment to employees or return remittance amounts from the original run AFTER you complete the manual entry (if time allows). Fees will apply.

The manual pay run feature is useful to post correcting(negative) entries to your payroll account. It functions like a manual journal entry in your accounting system - no payroll calculations are performed, just the entries you input are posted.

- Download the JOURNAL report under REPORTS>EARNINGS>JOURNAL that contains the payment(s) you need to reverse.

- Go to RUN PAYROLL (if you are prompted to end remittance period say no)

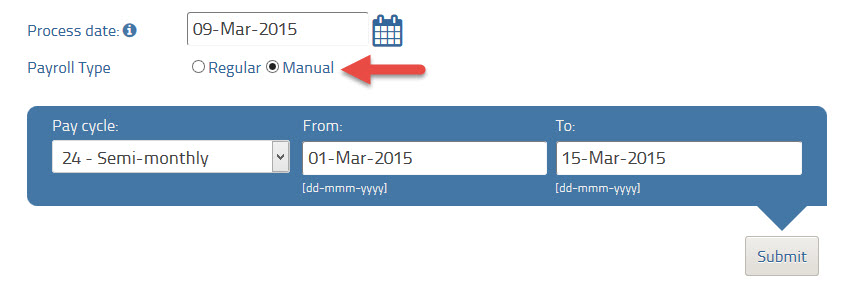

- Enter the dates exactly as they were on the incorrect pay run and select payroll type "Manual" and click Submit

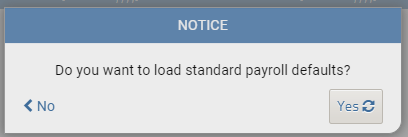

- You will get an option to load standard payroll defaults. We recommend you say yes if the employee is salaried for easier entry. If the employee is time-based please click no

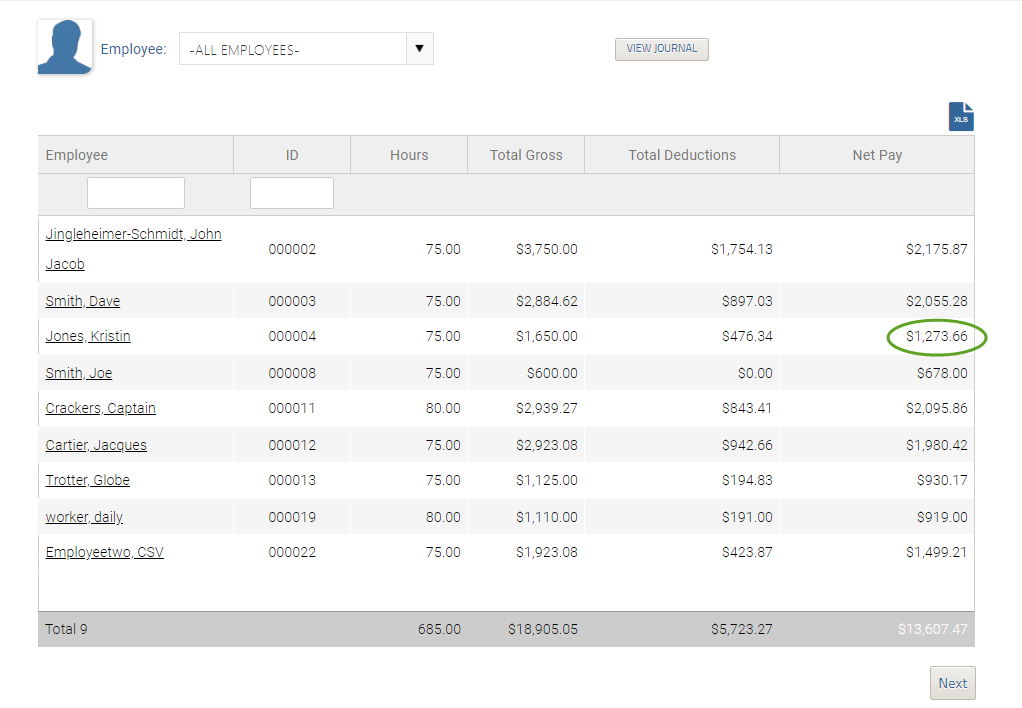

- You will now see a list of your employees. Select the employee you wish to post manual entries for by clicking on their name.

- Using the JOURNAL REPORT from the original pay run enter negative numbers for each item that shows a positive number on the report.

* Note: NO calculations will be performed - be sure to enter the data exactly as you see it on the JOURNAL. In the summary section, please ONLY enter the negatives for Insurable Earnings and Vacation Earned (if the employee accrues vacation OR it is released each pay). All other items will be totaled from details entered below.

7. SAVE the entry in order to calculate the amounts for net pay. The Net Pay should now be an EXACT negative of the original net pay (which would total 0.00 if combined) **Only saved employees will be moved to the PAYMENTS step. Continue the pay run as usual to post any further employee entries.

8. Click on the PAYMENTS step and you will see only those employees who were SAVED. Finish this pay run.

Important notes:

- This feature is only available to accounts registered with our accountant / bookkeeper partners.

- No payroll or other calculations are made using the manual entries using this feature

- Remember to email support@paymentevolution.com if you need to stop ANY payments associated with the original pay run.