Canada Emergency Wage Subsidy

Notice

Updated: Oct 11, 2020

We are retiring this report on August 1, 2024. If you require this report, please download it before August 1. After this date, it will no longer be available. Please note: The CRA requires maintaining at least seven years of records, so ensure you have downloaded any necessary reports before they are removed from your account.

The Government of Canada recently introduced the Canada Emergency Wage Subsidy (CEWS) program.

CEWS will cover up to 75% of the first $58,700 earned by employees. The program is in place from March 15 to November 21, 2020., however, the federal government recently announced its intention to keep the program open until June 2021.

How to Apply

The Canada Revenue Agency will administer the program through the My Business Account portal. The agency began accepting applications on April 27, 2020. Employers will need to keep records demonstrating their eligibility (reduction in eligible income) and any payments made to employees. Your PaymentEvolution account already maintains the remuneration records.

To expedite receiving a reimbursement, please consider enrolling in direct deposit with the CRA using the "My Business Account" portal.

Create the CEWS Report from your PaymentEvolution account

This report is available on the following plans:

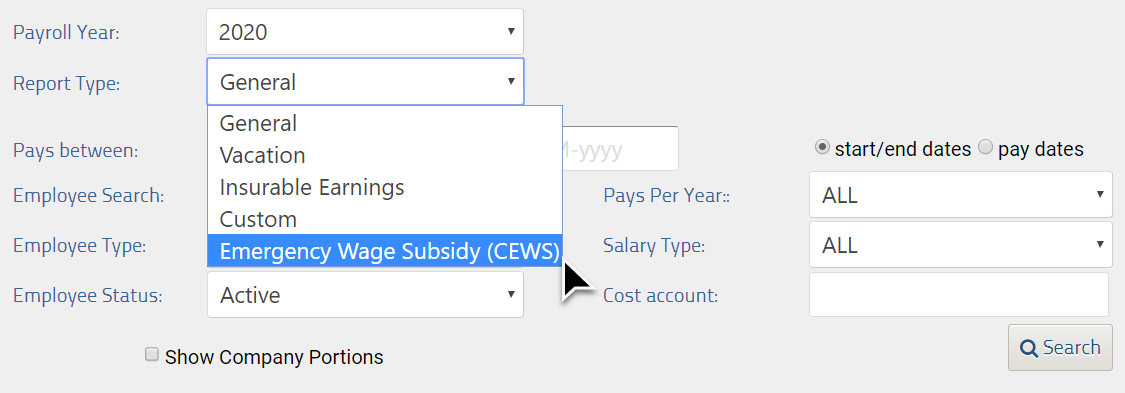

To generate the CEWS report in your PaymentEvolution account, navigate to REPORTS > PAY EXPLORER (DYNAMIC). Select Report Type "Emergency Wage Subsidy (CEWS)".

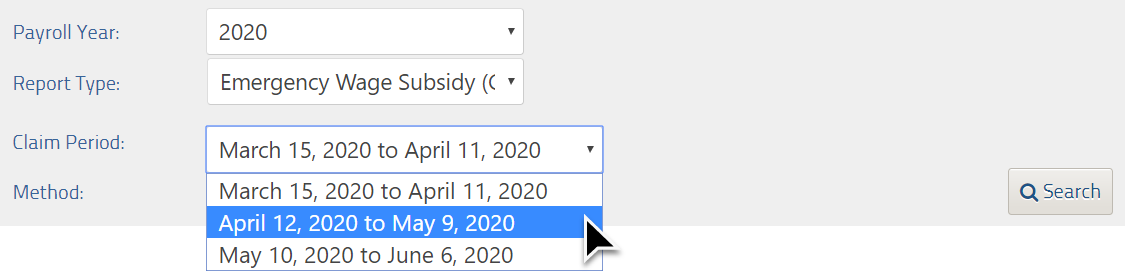

To change the claim period, use the drop-down box.

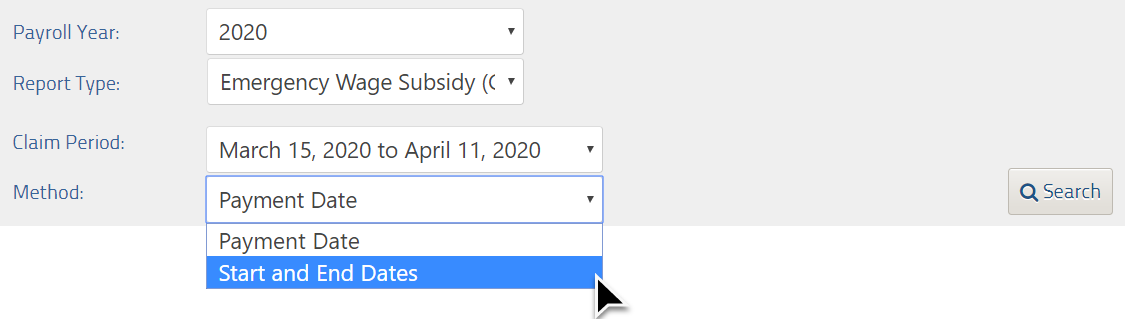

Select calculation method: by Payment Date or by using Start and End Dates (recommended: Start and End Dates)

Periods 1-4

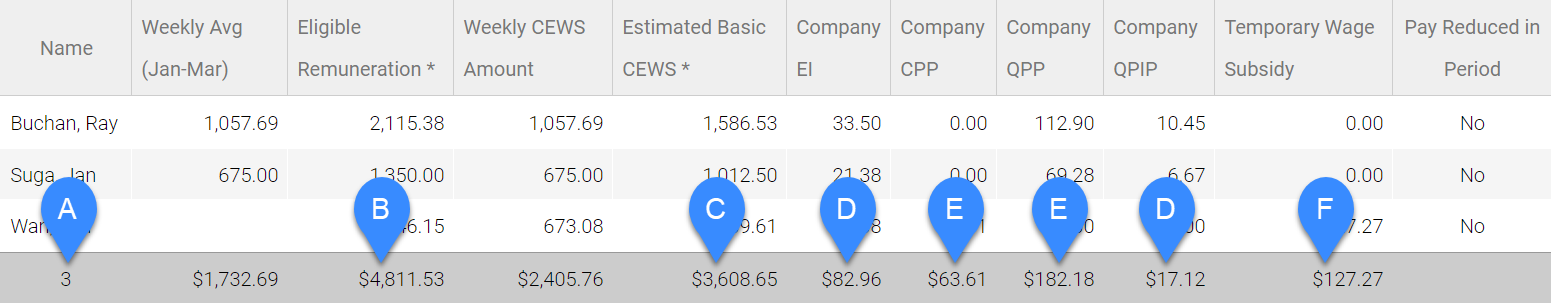

The report will collect data from the pay runs you have processed in your PaymentEvolution account.

Use the figures from the report to complete your submission on the CRA My Business Account portal.

Periods 5 and beyond

For periods 5 and later the CEWS amount is based on the percentage of lost revenue using a choice of a comparison period. This allows businesses who have had a less than 30% loss in revenue to participate in the program, while those with greater than 50% lost revenue can be eligible for an even higher rate than before.

CRA has provided a versatile calculator/spreadsheet to assist in your application. Your CEWS report has been modified to help complete the CRA CEWS spreadsheet. Follow the steps below to complete your application:

- Determine your gross revenue from the following months:

- April 2020

- May 2020

- June 2020

- July 2020

- You will also need to provide gross revenue from either

- Jan 2020 and Feb 2020 OR

- April 2019 to July 2019

- Access your CEWS report

- Go to REPORTS> PAY EXPLORER (DYNAMIC)>EMERGENCY WAGE SUBSIDY (CEWS)

- Select the applicable period (Note: period 1-4 will look different from period 5 and higher to accommodate the changes in the CEWS program)

- Select period 5 (or later)

- Download the report in XLS format

- Visit the CRA CEWS page

- Choose the option to the use the calculator. Choose your period and then select the option to download the calculation spreadsheet.

- Open the spreadsheet and complete Step 1

- On step 2A Weekly 52 - use the weekly spreadsheet regardless of your pay frequency and complete:

- Column A: Eligible employees - copy and paste these from your CEWS PAY EXPLORER (DYNAMIC) Report

- Column B: Select Yes/No to set employee arm's length status

- Column C: Average weekly gross pay Jan 1- Mar 15 - copy and paste from your CEWS PAY EXPLORER (DYNAMIC) Report (Note: if you choose to use July 1- Dec 31, 2019 you will need to fill this in manually for any non-arm's length employees)

- Columns D-G: indicate yes if any employee(s) were on paid leave (furloughed) during any of the weeks listed

- Columns H-K: for each of the 4 weeks listed - copy and paste these from your CEWS PAY EXPLORER (DYNAMIC)Report

- On Step 3 Amounts to Use: make note of these numbers for your CEWS application

- Go back to the CRA page

- Section 2b: Enter the values from Step 3 of your spreadsheet

- Section 3: Use your CEWS PAY EXPLORER (DYNAMIC) Report to add up any company portions for paid furloughed employees for EI/QPIP and CPP/QPP. Note: these numbers are a total from the entire time period. If your employees were furloughed for only part of the time you will need to manually calculate these amounts. Ask your accountant or bookkeeper or one of our payroll specialists to assist (fees may apply).

- Section 4: Enter any deductions

- TWSE should stay at 0 because this program has ended

- Any amounts employees have received user EDSC (enter 0 if not applicable)

- Section 5: Calculate your total wage subsidy and submit your application through the MyBusiness portal on the CRA site.

Period 17 and beyond

Employers can now apply for either CEWS or CRHP (Canada Recovery Hiring Program). The application is the same as CEWS and eligible employers can choose which one to use. For more information on the CRHP see HERE

Eligible Employers

Individuals, taxable corporations, partnerships of eligible employees, non-profits and charities who have seen a minimum 15% decline in revenue in March, and 30% decline in April and May 2020 (compared to the same period in 2019 or the average of revenues from Jan/Feb 2020) are eligible for the subsidy. The Government of Canada has extended eligibility to the following groups as well:

- Partnerships with up to 50% ownership by non-eligible members

- Partnerships comprised of Indigenous governments and eligible members

- Indigenous government-owned corporations

- Registered Canadian Amateur Athletic Associations

- Registered Journalism Organizations

- Non-public schools and colleges.

Calculating Revenues

Revenue for the purpose of this program will be revenue earned in Canada from arm's length sources. It would be calculated using your normal accounting methods but would exclude any extraordinary items and amounts.

There are three eligible periods for the subsidy. Calculation of the revenue shortfall will be according the chart below:

| Period | Wages paid during: | Reduction in Revenue | Calculate revenue shortfall by comparing: |

| 1 | March 15 - April 11, 2020 | 15% |

March 2020 to March 2019 or |

| 2 | April 12 - May 9, 2020 | 30% | April 2020 to April 2019 or Average of Jan and Feb 2020 |

| 3 | May 10 - June 6, 2020 | 30% | May 2020 to May 2019 or Average of Jan and Feb 2020 |

| 4 | June 7 - July 4, 2020 | 30% | June 2020 to June 2019 or Average of Jan and Feb 2020 |

| 5+ | July 5 - Dec 19, 2020 | varies | visit CRA site for details |

Employers would select the general year-over-year approach or the alternative approach (average of Jan/Feb 2020) when first applying for the CEWS and would be required to use the same approach for the entire duration of the program.

Eligible Wages

Eligible remuneration may include salary, wages and other remuneration for which you would generally withhold income taxes for. It does not include severance pay, stock option benefits or personal use of a company vehicle.

Eligibility for the CEWS of an employee’s remuneration, will be limited to employees that have not been without remuneration for more than 14 consecutive days in the eligibility periods.

The CRA will likely require accurate records of payroll and payments to staff - all of which are currently available in your PaymentEvolution profile.

Refund for Select Payroll Taxes

The Government of Canada is proposing measures to provide a 100% refund for certain employer-paid contributions to Employment Insurance, the Canada Pension Plan, The Québec Pension Plan and the Québec Parental Insurance Plan. Eligible employers would apply for a refund at the same time they apply for CEWS through the planned CRA portal.

For clarity, PaymentEvolution will still need to remit these taxes for you - but you can apply to have them refunded from the CRA when you apply for the CEWS.

CEWS and TWSE

Those who are not eligible for CEWS can continue to qualify for the previously announced 10% wage subsidy. Calculation support for the Temporary Wage Subsidy for Employers (TWSE) was available in your PaymentEvolution profile.

For employers that are eligible for both the CEWS and TWSE, any benefit from the 10% wage subsidy for remuneration paid in a specific period would generally reduce the amount available to be claimed under the CEWS in that same period.

The TWS program ended as of June 19, 2020

CERB

An employer would not be able to claim the Canada Emergency Wage Subsidy for remuneration paid to an employee in a week that falls within a 4-week period for which the employee is eligible for the Canada Emergency Response Benefit (CERB).

Employers who are not eligible for CEWS will still be able to furlough employees. These employees will receive up to $2,000/month under CERB.

Work-Sharing Program

For employers and employees that are participating in a Work-Sharing program, EI benefits received by employees through the Work-Sharing program will reduce the benefit that their employer is entitled to receive under the CEWS.

Calculation Methodology for CEWS Report

Notice

The calculation methodology refers to periods 1-4. For later periods, please refer to the CRA site.

The PaymentEvolution CEWS Report may be calculated using the Payment Date or the Start and End Dates method. If you previously used the Payment Date method for submissions to the CRA, please continue using this method for future submissions.

Payment Date:

CEWS Eligible Amount: For the claim period selected, any pay dates within that period are used to create a normalized weekly average.

Example: A semi-monthly employee was paid twice in the claim period for a total of $3000 ($1800 + $1200)

- Calculate Average Pay during this period: $1800 + $1200 / 2 = $1500 average pay

- Add each pay $1500 + $1500 = $3000 total for the claim period

- Find the average $3000 / 2 payments = $1500 average per pay cycle

- Normalize the pay to a weekly amount:

- $1500 x 24 pays per year (semi-monthly) = $36000 annually

- Annual $36000 / 52 (number of weekly periods) = $692.31 average earnings per week during claim period

- Calculate CEWS eligible amount 75% up to $847/week

- Average weekly earnings $692.31 x 0.75 = $519.23.

- The system will then go back re-normalize semi-monthly and monthly periods to account for the fact that a year is 52 weeks (not 48: 12x4=48). This creates an amount that is accurate over a year time period.

- In our example above the CEWS basic claim amount will actually be $2250 (or $562.50) for the claim period which takes into account the extra day(s) in a semi-monthly pay cycle as compared to a week.

- If an employee earns more than $1129.33 per week, take the maximum allowed subsidy of $847/week

Temporary Wage Subsidy for Employers: This is the amount of TWSE already taken for this employee based on data in your PaymentEvolution account. If the employee was eligible but you did not take the subsidy, you must still use the total amount you are eligible for. If you do not subscribe to PaymentEvolution remittance services you will need to manually reduce your total. The CRA will apply any unused amounts at year-end.

Company CPP / EI / QPP / QPIP: The amounts in these columns represent the company portions paid for these programs for each employee during this claim period. If the employees are continuing work (i.e. not on leave with full/partial pay) please exclude these amounts.

Weekly Avg (Jan-Mar) and Weekly CEWS Amount: use figures in these columns if you need to manually calculate the Basic CEWS amount using the Canada Revenue Agency spreadsheet provided on their site. The Weekly CEWS amount does a basic weekly average, based on payment date without recalculating for semi-monthly and monthly per Estimated Basic CEWS.

Example: A semi-monthly employee was paid twice in the claim period for a total of $3000 ($1800 + $1200)

- Calculate Average Pay during this period: $1800 + $1200 / 2 = $1500 average pay

- Add each pay $1500 + $1500 = $3000 total for the claim period

- Find the average $3000 / 2 payments = $1500 average per pay cycle

- Normalize the pay to a weekly amount:

- $1500 x 24 pays per year (semi-monthly) = $36000 annually

- Annual $36000 / 52 (number of weekly periods) = $692.31 average earnings per week during claim period

Start and End Dates:

- All payments with start and end dates that fall within the claim period

- Earnings are averaged to a daily amount for each pay

- The number of days of pay that fall within the claim period are calculated

- Earnings are divided into the 4 weeks of the claim period using the CRA weekly method

- Results are compared to the maximum allowed amount for each week

- The weeks are totaled to derive the basic CEWS claim

- TWSE/CPP/EI/QPP/QPIP all use a factor of the eligible remuneration during the period

Employment and Social Development Canada's Work-Sharing benefit program: For employees who take part in a work share program, you will need to reduce the CEWS eligible amounts by the amounts received by employees during the claim period under this program.

Notice

Your PaymentEvolution account supports multiple pay periods, employee types and wages to reduce your administration burden. However, the service can only work with the information it has. For example, the service will not know if someone is a non-arm's length employee (such as a family member), the days in the period that were worked versus not worked, or if a current payment was for a retroactive period. There may be other non-standard cases the service cannot apply a calculation for, such as severance pay. If you suspect reporting may not accurately reflect the special circumstances for an employee, we strongly recommend consulting with your accountant and/or the Canada Revenue Agency before submitting your CEWS claim.

FAQs

Which report calculation method should I choose?

Use the Start and End Date method. Previously, the CRA did not provide guidance on the preferred methodology. The Payment Date method corresponds to the CRA preferred method for most other tax programs, however, the CRA has clarified that the Start and End Date method is now preferred for calculation of the Canada Emergency Wage Subsidy. The Payment Date method is provided for reference.

What do I do if I already submitted a claim and feel it is not correct?

According to the CRA, you will have an opportunity after June 1, 2020 to request an adjustment or change a previously submitted claim.

What if the CRA changes the methodology again?

The CRA provides regular updates and is adapting to announced Government of Canada programs. As these changes are communicated, your PaymentEvolution team continues to adapt and make any necessary updates. We recommend keeping detailed records of your pay runs for any potential questions that may arise. Your PaymentEvolution profile maintains these records for you.

CRA has added boxes 57, 58 59 and 60 to the T4s for 2020, how do I do this?

Your payroll system is fully compliant with CRA requirements, so boxes 57-60 will be pre-filled with any pay dates run through your account on the employee T4 slips. If you ran payroll through another program for some of these dates you can manually update the information on the slips as needed for these boxes. The boxes for reporting payments are:

- Code 57: Employment income – March 15 to May 9

- Code 58: Employment income – May 10 to July 4

- Code 59: Employment income – July 5 to August 29

- Code 60: Employment income – August 30 to September 26